Microsoft launched Bing on June 3, 2009, as a challenger to Google.

Fast forward to 2025, and Bing has secured its place as the world’s #2 search engine with a 3.9% global market share and 450+ million daily searches.

Bing is also tightly integrated into Microsoft’s ecosystem, spanning Windows, Office, Xbox, and AI Copilot, which gives it a reach beyond traditional search.

Here, I’ve compiled the latest Bing statistics covering market share, daily searches, ad performance, demographics, based on authoritative sources including Microsoft and leading industry research.

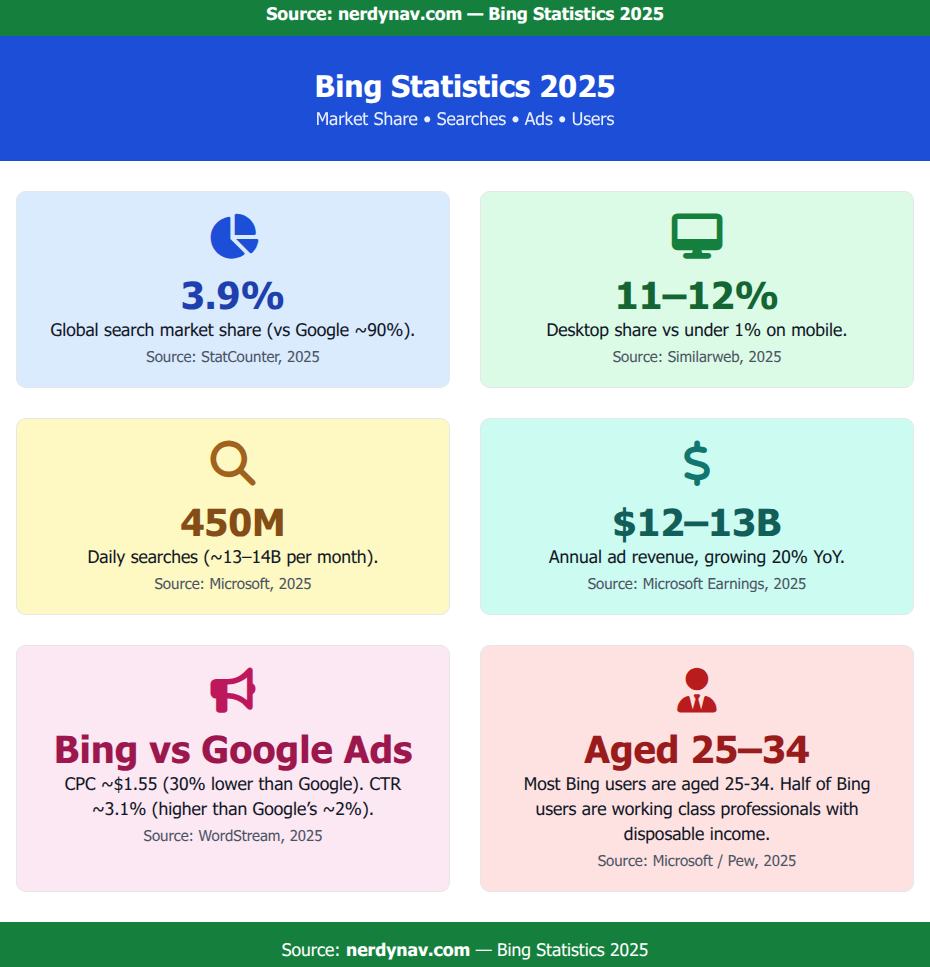

Key Bing Statistics 2025

- 3.9% Market Share Bing is the world’s #2 search engine with a 3.9% global share, trailing Google’s ~90%.

- 12% Desktop Share Bing is strongest on desktop (11–12% share) but holds less than 1% of the mobile market.

- 450M Daily Searches Bing handles roughly 13–14 billion searches per month, averaging 450 million every day.

- “Google” is #1 Query The most searched term on Bing worldwide is “Google,” followed by YouTube and Facebook.

- $13B Ad Revenue Microsoft earns ~$13 billion annually from Bing Ads, with revenue growing nearly 20% year-over-year.

- 30% Lower CPC The average cost-per-click on Bing Ads (

$1.55) is 30% lower than Google Ads ($2.20). - 3.1% Click-Through Bing Ads average a 3.1% CTR, significantly higher than Google’s 2% industry average.

- Affluent Audience Half of Bing users are in the top 25% of household incomes; 41% in the US earn over $100K/year.

- 26% Share in China Bing has seen massive regional growth in China, reaching up to 26% market share in 2025.

- 10B Copilot Chats Since integrating AI, users have conducted over 10 billion chats through Bing and Edge.

Market Share

- Global (Apr 2025): Bing holds 3.88% of the worldwide search market, compared to Google’s 89.66% (StatCounter).

- United States (Aug 2025): Bing has 8.01% share; Google leads with 85.7% (StatCounter).

- China (Apr 2025): Bing reached 26.1% share, though this dipped to ~19.2% by July 2025 (StatCounter).

- Europe (Aug 2025): Bing’s share is ~3.95% vs Google’s 90.25% (StatCounter).

- Desktop vs Mobile: Bing commands ~11–12% of desktop searches, but less than 1% of mobile searches (StatCounter, 2025).

Global Search Engine Market Share

| Search Engine | Market Share (Apr 2025) |

|---|---|

| 89.66% | |

| Bing | 3.88% |

| Yandex | 2.5% |

| Yahoo! | 1.3% |

| DuckDuckGo | 0.8% |

| Baidu | 0.7% |

*Source: StatCounter *

Search Volume

Bing processes billions of searches every month, though still far behind Google.

- Bing handles an estimated 13–14 billion searches per month (≈450+ million per day, or ~5,400 per second).

- By comparison, Google processes over 200 billion searches per month.

- The most searched query on Bing worldwide is “Google”, with ~40.96 million monthly searches (Ahrefs, 2025).

- In the U.S., “YouTube” and “Gmail” are among the top Bing queries, alongside “Google” itself.

Top Global Bing Searches

| Rank | Search Term | Monthly Searches |

|---|---|---|

| 1 | 40,960,000+ | |

| 2 | YouTube | 35,000,000+ |

| 3 | 28,500,000+ | |

| 4 | Gmail | 15,800,000+ |

| 5 | Amazon | 7,800,000+ |

*Source: Ahrefs *

Advertising & Revenue

Search advertising remains Bing’s primary revenue driver, and Microsoft continues to report strong growth in this segment.

- Microsoft’s search advertising revenue (which includes Bing Ads) grew ~20% year-over-year in 2024 and continues to expand in 2025 (Search Engine Roundtable).

- Analysts estimate Bing Ads contributed $12–13 billion annually to Microsoft’s revenue in FY2024.

- Bing Ads average CPC is ~$1.55, about 30% lower than Google Ads.

- Average CTR on Bing Ads is ~3.1%, higher than Google’s ~2% industry average.

- Conversion rates average ~3.5%, depending on industry benchmarks.

Bing Ads Revenue by Year

| Fiscal Year | Revenue (USD, est.) |

|---|---|

| 2024 | $12–13 billion |

| 2023 | $12.21 billion |

| 2022 | $11.6 billion |

| 2021 | $8.53 billion |

| 2020 | $7.74 billion |

| 2019 | $7.63 billion |

Sources: Microsoft earnings reports, Search Engine Roundtable (2024–2025)

Traffic by Country

Bing.com remains one of the most visited websites globally, with billions of visits each month.

In July 2025, Bing.com recorded ~2.39 billion visits (SEMrush), ranking #14 worldwide and #12 in the U.S. by traffic.

Top Countries by Bing.com Traffic (July 2025)

| Country | Share of Traffic |

|---|---|

| United States | ~30.0% |

| China | ~16.0% |

| India | ~5.0% |

| United Kingdom | ~3.84% |

| Brazil | ~3.80% |

| Canada | ~2.5% |

| Germany | ~2.3% |

| Japan | ~2.0% |

| France | ~1.9% |

| Australia | ~1.5% |

Source: SEMrush (July 2025)

- The U.S. is Bing’s largest traffic source, accounting for ~30% of visits.

- China contributes ~16% of Bing’s traffic, reflecting its role as a major alternative to Baidu.

- India now accounts for ~5% of Bing’s traffic, showing steady growth from negligible levels in past years.

- In Europe, Bing holds ~4% share in the UK (July 2025) and ~6% in Germany (Mar 2025) according to StatCounter.

Bing User Demographics

Bing’s audience has distinct demographic characteristics compared to Google’s broader user base.

Recent data from SimilarWeb and Microsoft Advertising highlight the following trends:

- Age: The largest segment of Bing users is 25–34 years old, followed by 35–44.

- Gender: Bing’s user base is predominantly male (~63%), with females making up ~37%.

- Income: Roughly half of Bing users are in the top 25% of household incomes. In the U.S., 41% of Bing users earn over $100K/year.

- Education: While recent global data is limited, Microsoft Advertising previously reported that a significant share of Bing users are college graduates.

- Desktop-Only Usage: Bing is overwhelmingly a desktop search engine. With ~11–12% desktop share vs < 1% mobile share, the vast majority of Bing users are effectively desktop-only searchers.

These demographics make Bing particularly attractive for advertisers targeting affluent, working-age professionals.

Search Behavior on Bing

Bing’s search activity is heavily skewed toward branded and navigational queries.

Many users rely on Bing to reach other major platforms and services.

- Search Volume: Bing processes an estimated 13–14 billion searches per month (~450+ million per day, ~5,400 per second).

- Top Query: The most searched term on Bing worldwide is “Google”, with ~40.96 million monthly searches (Ahrefs, 2025).

- Other Leading Queries: YouTube, Facebook, Gmail, Amazon, and “Bing homepage quiz” consistently rank among the top searches.

- U.S. Queries: In the U.S., “YouTube” and “Gmail” are among the most common Bing searches, alongside “Google.”

- Branded Bias: A higher proportion of Bing’s search volume is for known brands and websites, compared to Google’s broader mix of long-tail queries.

Top Global Bing Searches

| Rank | Search Term | Monthly Searches |

|---|---|---|

| 1 | ~40.96M | |

| 2 | YouTube | ~35.3M |

| 3 | ~28.5M | |

| 4 | Gmail | ~15.8M |

| 5 | Amazon | ~7.85M |

| 6 | Bing homepage quiz | ~5.57M |

| 7 | Bing | ~4.62M |

| 8 | News for you | ~4.29M |

| 9 | Yahoo | ~3.74M |

| 10 | eBay | ~3.42M |

Sources: Ahrefs , SEO industry reports

AI Bing Copilot

Microsoft’s integration of AI into Bing, branded as Copilot, has been the biggest driver of renewed interest in the search engine.

Launched in February 2023, Copilot combines Bing search with conversational AI, image generation, and integration into Microsoft Edge, Windows, and Microsoft 365.

- Total Chats: By the end of 2023, Bing and Edge users had conducted over 1.9 billion AI-powered chats.

- 2024 Growth: By late 2024, users had held more than 10 billion Copilot chats in Edge and Bing (WindowsCentral).

- Image Generation: The Bing Image Creator has produced over 750 million AI images as of early 2024.

- App Downloads: Following the launch of Copilot, Bing’s mobile app downloads spiked more than 10× globally. In February 2023, Bing briefly reached #12 in the U.S. App Store (TechCrunch). It has since remained a top-20 app in many markets.

- Edge & Windows Integration: Copilot is now deeply integrated into Microsoft Edge and Windows 11, with Microsoft reporting billions of chats conducted directly through Edge in 2024.

- Microsoft 365 Integration: Copilot features have also been rolled out across Word, Excel, Outlook, and Teams, though no public usage figures have been disclosed.

While Microsoft has not released updated 2025 totals, industry analysts note that Copilot continues to drive Bing’s traffic and engagement, making it the only consumer search engine platform showing growth in recent years.

Bing Market Valuation

- Estimated Valuation: Bing is not a standalone public company, so valuations are speculative. Analysts and industry commentators place Bing’s value in the low tens of billions of dollars, far below Google’s ~$1–2 trillion market cap.

- Revenue Contribution: Microsoft’s total revenue in FY2024 was ~$200 billion. Bing’s advertising business contributed an estimated $12–13 billion, or a few percent of the total.

- Global Rank: Bing.com ranks #14 globally and #12 in the U.S. by web traffic as of mid-2025 (SEMrush/SimilarWeb).

- Branded vs Non-Branded Searches: Bing’s query mix is heavily weighted toward branded searches (Google, YouTube, Facebook, Gmail, Amazon), unlike Google which has a larger share of long-tail informational queries.

- Growth Since Copilot: Bing’s desktop market share rose from ~9–10% pre-2023 to ~11–12% by early 2025 (StatCounter). Traffic and engagement have surged with AI integration, making Bing the only major search engine showing consistent growth in recent years.

- Enterprise Usage: Microsoft Advertising surveys show that 55% of U.S. business users use Bing for product research and 38% for brand discovery, highlighting its role in enterprise search and advertising.